The underlying trend of today’s technology and lifestyle is simplicity and convenience. And that is exactly what digital banking is all about — make banking fast and simple.

There is a rapidly growing demand for independent digital banking solutions, especially in metropolitan areas, capital cities. Consumers have turned to non-cash payments via the Internet and smartphones to help them fulfill their needs safely and conveniently.

So how can you get started or enhance your existing digital banking strategy? This article brings you 18 must-have features of a digital banking system.

What is Digital Banking?

Before getting to know 18 key digital banking features, here’s a visual equation that sums up (literally) digital banking:

Online Banking + Mobile Banking = Digital Banking

Online banking means accessing banking features and services via your bank’s website from your computer. You may log into your account to check your balance or pay your electricity bill. You can access additional banking features, such as applying for a loan or credit card, at many banks via your online banking portal.

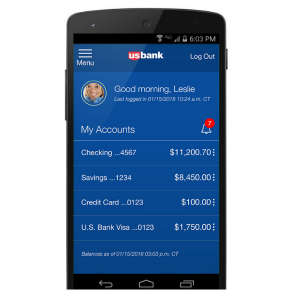

Mobile banking means using an app to access many of those same banking features via mobile devices such as smartphones or tablets. These apps are proprietary, issued by the bank where you hold your account, and usually use the same login information as your online banking portal.

Together, online and mobile banking creates the digital banking umbrella, giving people access to banking wherever they may be—or, in some cases, wherever they’re graced with secure Wi-Fi and strong cell signal.

Trends in Digital Banking Services Technology

Banking is quite a conservative niche. However, with digital transformation, even financial services caved into popular demand and convenience. The idea of building a digital bank is to move the traditional activities and services to the web and reduce or remove the need for an individual to be physically present in a bank.

Going digital helps the banks meet the increasing expectations as well as the trend of transactions on electronic devices of customers, simplifying processes, processing procedures, improving competitiveness, cut down the costs. First of all, let’s learn about the trends and technologies used in digital banking.

[su_tabs vertical=”yes”][su_tab title=” Virtual cards” disabled=”no” anchor=”” url=”” target=”blank” class=””]A representation of your actual card that can be easily disposed of if something happens to it. For example, if a virtual card is hacked, you can delete it and create a new one, while the real cards won’t be compromised in any way. It is used for more convenience of transactions and security.[/su_tab] [su_tab title=” Automation interactions” disabled=”no” anchor=”” url=”” target=”blank” class=””]Text and video chats are already a must for banking institutions; the next step is to use AI to power the conversations (e.g., Cleo). Automation helps reduce staffing costs by minimizing interaction with humans only when it is necessary — why spend human work time answering simple, routine questions.[/su_tab] [su_tab title=” Mobile banking” disabled=”no” anchor=”” url=”” target=”blank” class=””]Cashless mobile banking is one of the quickest growing and popular trends. The mobile bank is the choice of the younger generation. They strive for the convenience of pinging smartphones against a connected device instead of the hassle of carrying cash and waiting for change. [/su_tab] [su_tab title=”Cybersecurity” disabled=”no” anchor=”” url=”” target=”blank” class=””]Consider the newest fraud-prevention technology before you make your bank. For example, machine learning models based on real-time insights are used for detecting fraudulent activity. You can also implement device fingerprinting where the system, based on several parameters, identifies whether a device has been used in fraud-related activities.[/su_tab][/su_tabs]

18 Key digital banking features to Build a Digital Banking System

Online banking is the future and it’s important to build high-quality digital banks and online financial services. How can you do that? Let’s discuss all the important details you need to know and keep in mind when starting a digital bank.

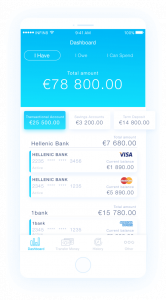

1. Personal Money Management Dashboards – 1st digital banking features

Personal money management dashboards are created in a way that can be easily customized to different audience segmentations. This delivers amazing and personalized user experiences.

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Personal money management dashboards are targeted to different customer segmentations.

- Customers can fully control their dashboard: add or remove the functional widgets and create their own customized dashboard by adjusting.

- Personal preferences are recorded for every device to easily navigate to the customer’s personal dashboard, which can be optimized for relevant devices.

- Display actionable insights and marketing campaigns for each customer.

[/su_list]

2. Products & Transactions – 2nd digital banking features

An all-inclusive list of transactions – from numerous accounts and products and the capable searching abilities. Allow clients to search for any transactions through multifunctional filters and approach any transactions in the most detailed way.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

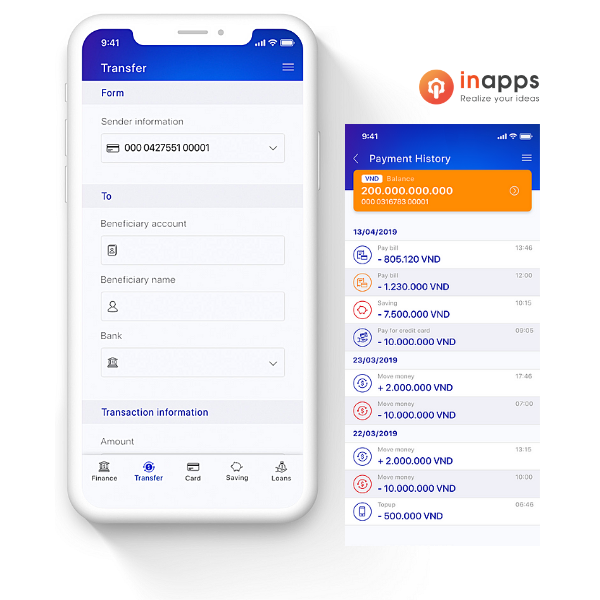

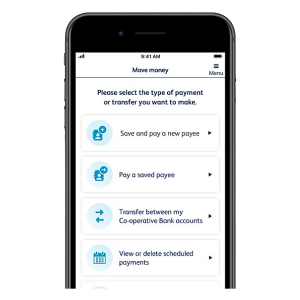

3. Consistent Money Movement

Types of the transactions are combined to create a seamless user experience, which allows remembering transactions/payments, process scheduled transactions, and centrally managing all these payments.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

4. Centralized Account Management

Our ready support allows banks to integrate multiple accounts from third parties and start to widen payments, promote the success of the Open banking effort. Ensure compliance with Revised Payment Service Directive (PSD2), Account Information Service Provider (AISP), or Payment Initiation Service Provider (PISP) standard. Join the open banking revolution and ensure endless customer journeys.

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

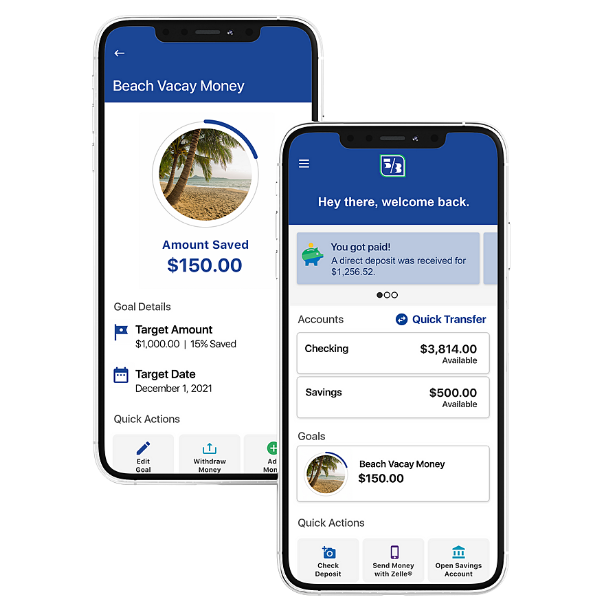

5. Personal Finance

Predictive money planning abilities enable clients to follow up expenses, visualize cash activities and how they affect liquidity. Provide a better understanding for customers about the inflows and outflows of money.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

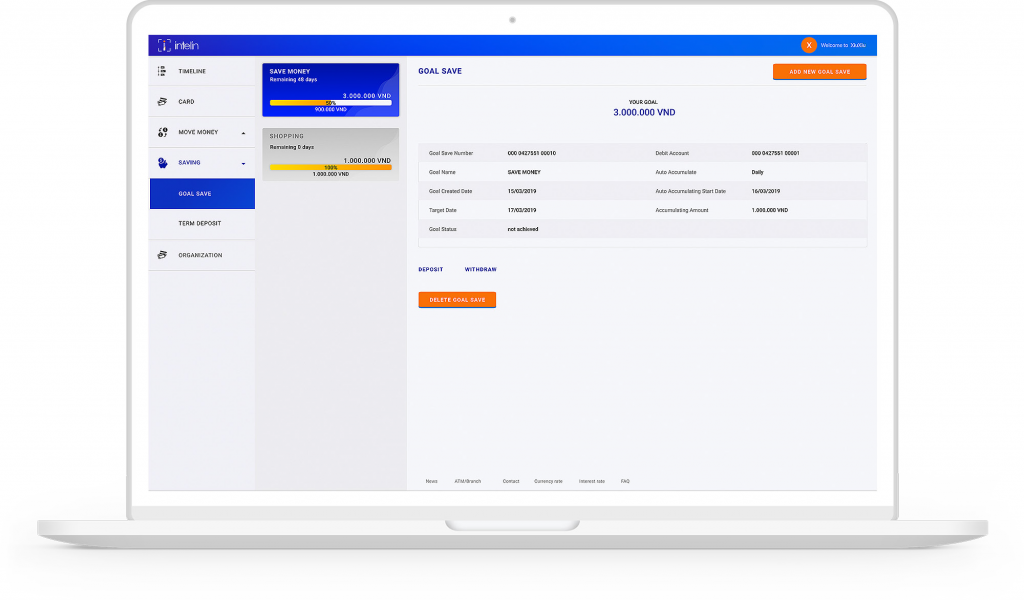

6. Plans & Goals

Support customers by manage existing accounts, enable customers to make plans, manage budgets, and saving targets through a fully incorporate and intuitive interface.

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

7. Service Management

Provide new clients an easy registration process to form their client’s experience from the beginning. Incorporate with Know-Your-Customer (KYC) services and Anti-Money-Laundering (AML) services to accelerate the process.

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Enable clients and staffs to shape products in an intuitive and convenient way.

- Make use of mobile devices to scan and upload important documents apart from friction.

- Link to KYC/AML services (credit verify, identity verify,…)

- Channel switcher – protect the interaction context and client data across channels.

- Gather, tackle digital and electronic signatures.

[/su_list]

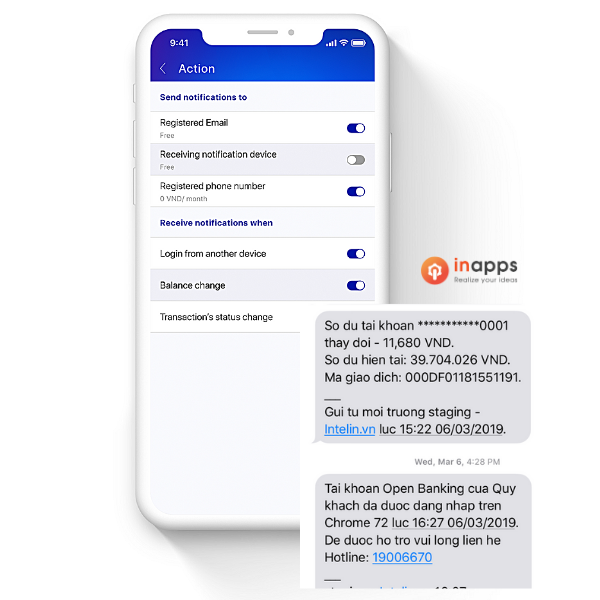

8. Centralized Information Management

Centrally manage alerts/notifications, allow customers to communicate safely and securely. Our solution protects sent and received messages using common security types for digital banking transactions.

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Easily connect to the existing customer contact center or front-office support platform.

- Secured mail/message can be used for any type of query, including account and transaction queries, product information, or transaction error explanation.

- Centralized information management will be integrated directly with Notifications and Smart actions, allows customers to receive notifications of successful/failed/scheduled transactions, account balance changes, or an increase in daily limits,…

[/su_list]

9. Adjustments & Notifications

Our solution provides notifications that can be customized personally. From that, banks can manage and create relevant notifications and suggestions at the most suitable time.

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

10. Smart Banking – digital banking features

Smart banking means using more and more smart approaches and smart personal financial management which allows customers to identify what are the smart actions helping them to automate manual tasks and providing smart context knowledge to improve their financial status.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

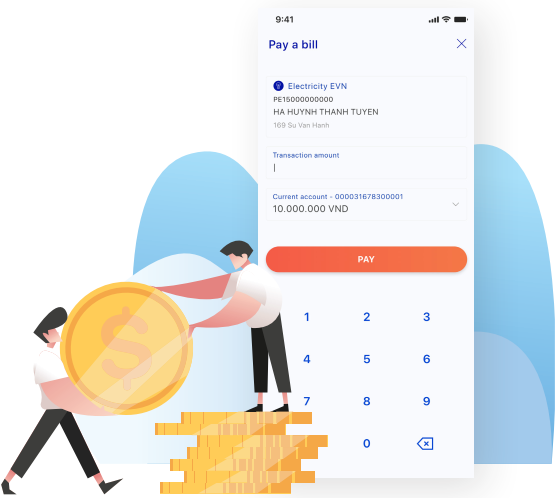

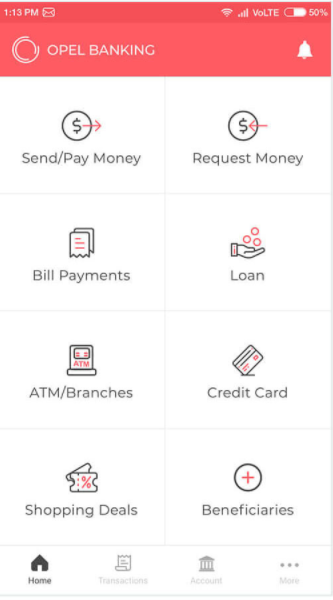

11. Bill Payments – digital banking features

Bills are arranged together in one place. Customers can keep track and pay bills efficiently without any confusion. Our solution provides a bill reminder function that can remind users to pay a bill on time, refrain from late payment fees and penalties. Whenever due dates are coming, customers will be notified.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

12. Term Deposits – digital banking features

Allow customers to easily set up and create their check deposits on smart-phone at any time and anywhere. Easily capture the transaction receipt to ensure success for first-time users, improve a higher usage and rating.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

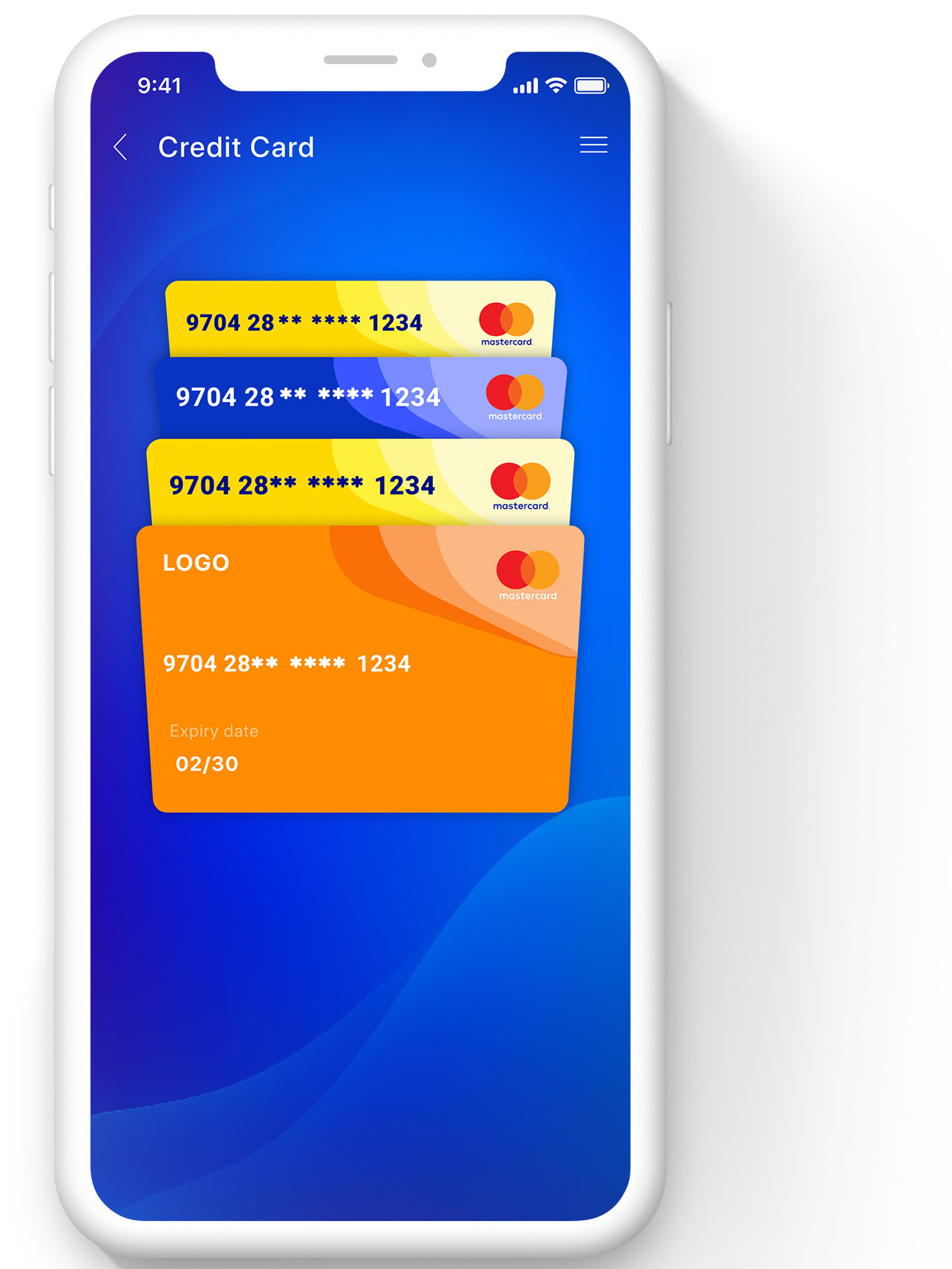

13. Card Management

Provide self-service products to help customers manage multiple cards (debit card and credit card). Integrate Middleware system in the back-end. Improve customer experience and minimize customer support queries.

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

14. Deposits & Loans

Display the overview of all deposits and loan accounts, simplify loan processing and approvals. Fully understand the entire picture of deposits and loan agreements.

|

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

15. Profile Details

[su_list icon=”icon: check” icon_color=”#ef5808″]

[/su_list] |

|

16. Seamless Security

Provide strong authentication at the transaction time, and evaluate risky situations to enhance the security of data and transactions.

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Centrally manage identity to provide, update, and take back granted access permission.

- Quickly adapt to security and authentication policies based on user context and devices. Increase ability to acquire multiple authentications in case of risky situations.

- Single login easily accesses many functions with only one identity.

- Easily integrate with other identity management and authentication systems.

[/su_list]

17. Address Book

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Integrated with the address book for easy payments.

- Seamless connection to mobile devices and social networks.

- Offer P2P payments through Email, phone number, or social profile details.

[/su_list]

18. Atm/Branch Locator

[su_list icon=”icon: check” icon_color=”#ef5808″]

- Full view of nearest ATMs/Branches.

- Integrated with Google Map that allows easy navigation.

- Advanced search and filter options, based on opening hours and services.

[/su_list]

View more: Case Studies

Ready to get started with your digital banking strategy?

Banking App Development Experts

We’ve already had +10 years of experience in designing, and managing software, solving problems for many kinds of mobile apps/web, and specially developed Digital Banking Applications for international startups, SMEs & enterprises.

Why you would love to work with InApps:

– Our innovative team offers the best solutions based on the insights of your business model.

– Our talented developers are conscientious with high troubleshooting.

– We are ready to support and communicate with you 24/7 to understand the business goals, the status of products, and the priority that you expect to solve.

– We are a trusted partner for a long-term companion with a guarantee policy: Most of our ongoing projects have phase 2, phase 3, and more.

– Always commit to the deadline and regularly update the development status.

>> Read more: Our Clients’ review on Clutch

Why InApps?

- Reduce your cost by up to 70% – Guarantee the same or higher quality

- Available 24/7 – Solving-problem & supporting your end-users anytime, anywhere

- 80% of developers are good at English communication – No more language barrier!

- 90% of software developers have +5 years of experience

- High-level of Tech skills — Talented workforce from US, Australia, Northern Europe, or Japan

- Transparency and Predictability for long-term cooperation

- Latest Development Methodologies & Diverse Industry Experiences

Let’s create the next big thing together!

Coming together is a beginning. Keeping together is progress. Working together is success.